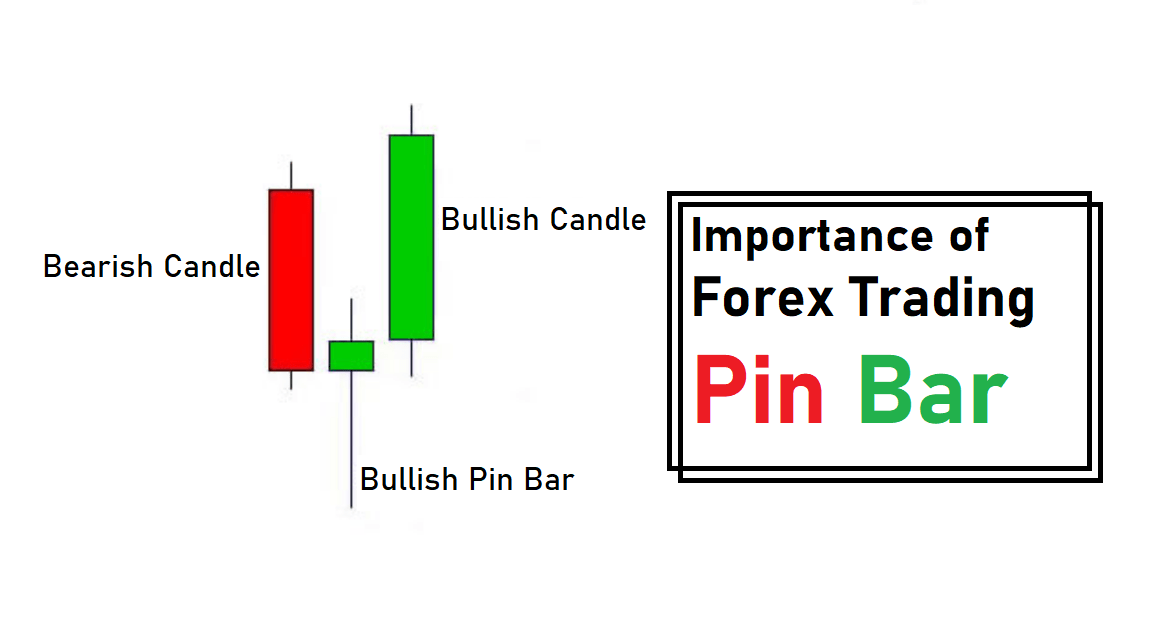

Importance of Forex Trading Pin Bar

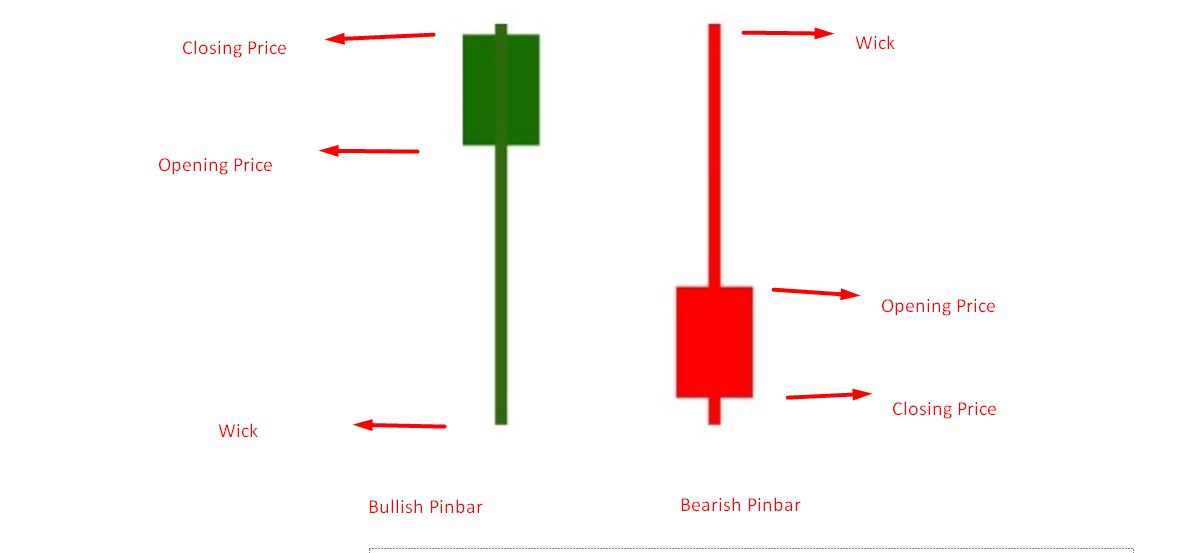

BTCUSD. , 30 Education. EliteTradingSignals May 29, 2023. The pin bar is a powerful price action setup that tells a fascinating story concerning price momentum and the possibility of an imminent reversal in price direction. A pin bar is a Japanese candlestick that has a long wick on one side and a small body. Understanding the story behind the.

Pin Bar Trading Patterns Forex Strategy

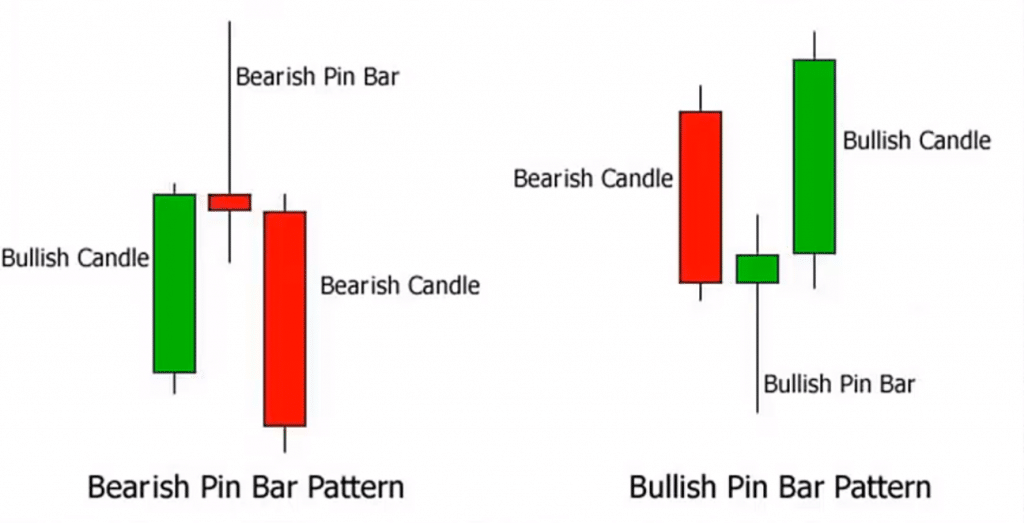

A pin bar is a single candlestick with a long tail (wick) who's price action demonstrates a rejection of a price level and reversal in price closing near its high (bullish pin bar) or low (bearish pin bar) for a user defined session. You can find pin bars using a bar chart or candle stick chart on any time frame in any market including Crypto.

Pin Bar Trading Strategies that Work Pro Trading School

The most characteristic feature of the pin bar the 'nose'. Pin bars have a long nose (aka candle wick) which protrudes out of one side of the candle body. To qualify as a pin bar, the open and close must be situated at one end of the bar's range, and the nose of the bar must make up at least 2/3's of the whole bar's range.

Pin Bar Trading Trading charts, Trend trading, Trading quotes

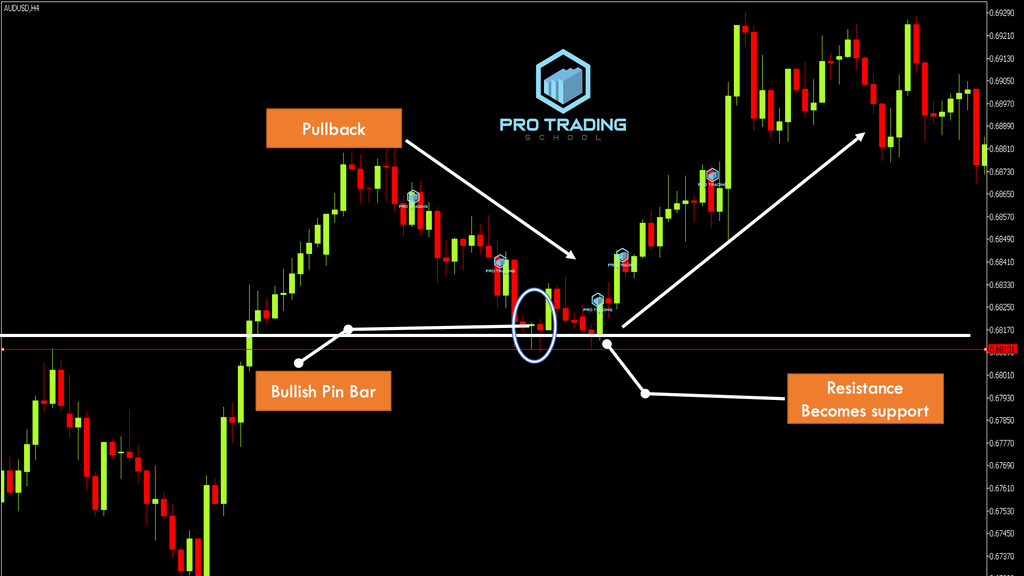

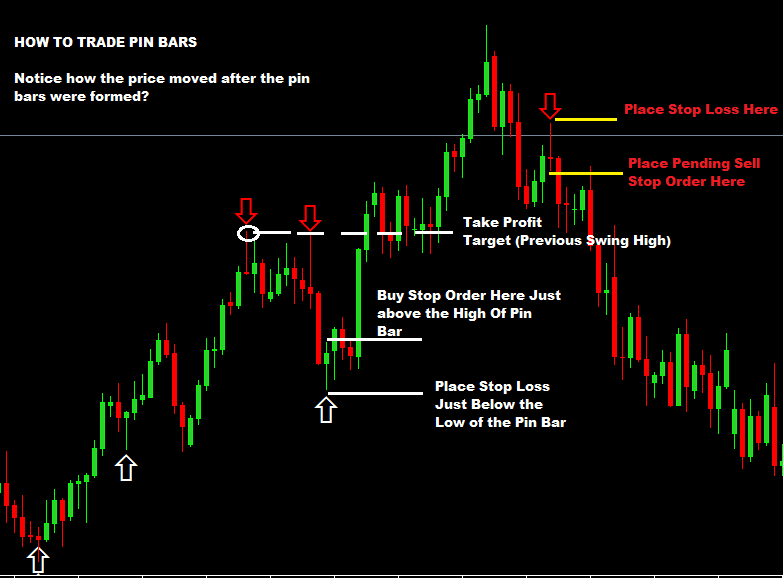

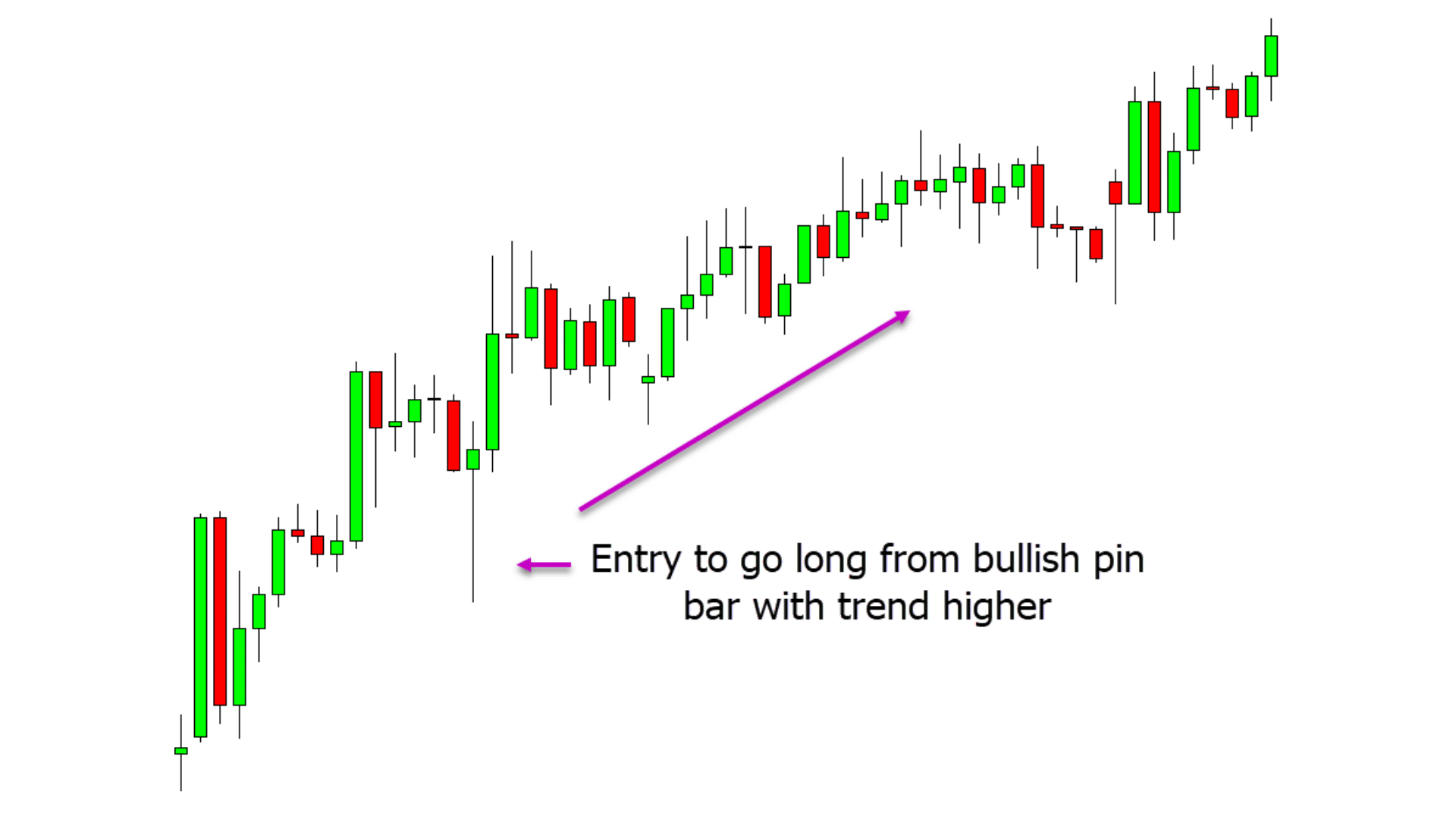

Trading Pin Bar Signals in a Trending Market. Trading with the trend is arguably the best way to trade any market. A pin bar entry signal, in a trending market, can offer a very high-probability entry and a good risk to reward scenario. In the example below, we can see a bullish pin bar signal that formed in the context of an up-trending market.

Best 'Pin Bar' Forex Trading Strategy 2020How to Trade Pin Bar

The most popular way to trade a pin bar is to look at key levels and wait for a rejection of the level in the form of a pin bar. As shown above on this GBPUSD chart, price moved up to a level of significance. Once at the level, price formed a pin bar indicating selling pressure, or a lack of bullish pressure in this price region.

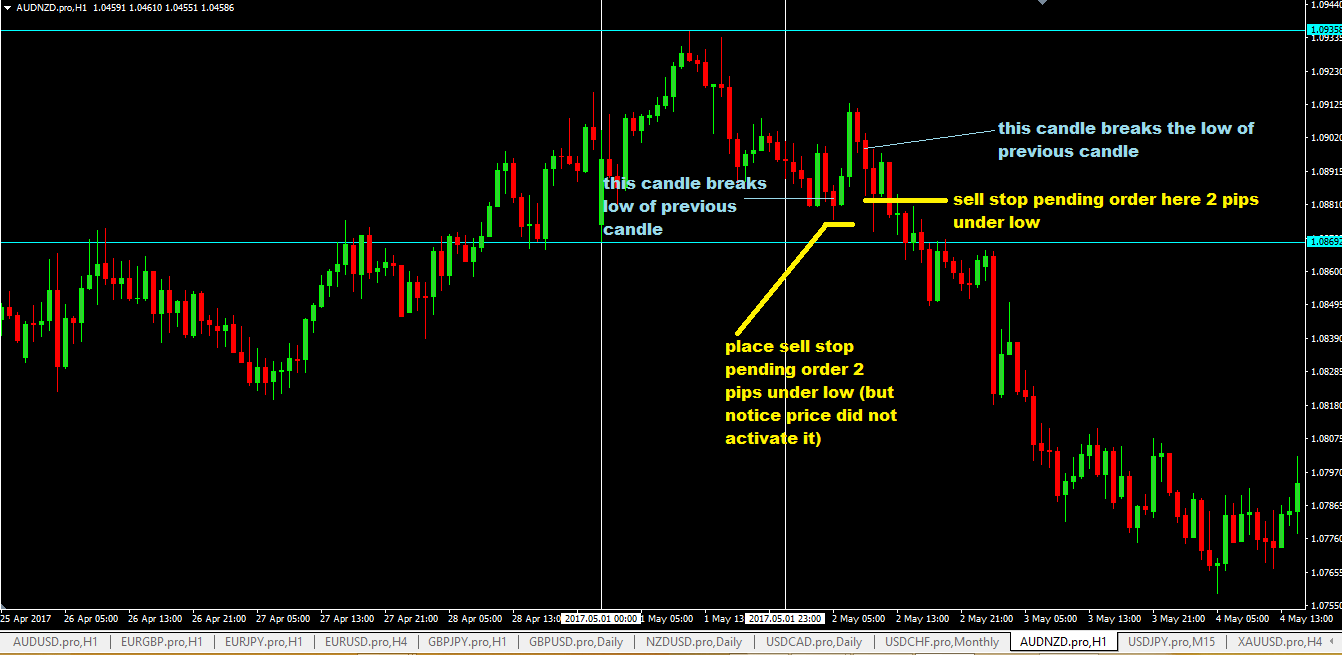

Daily Pin Bar Forex Trading Strategy With Mutliple Timeframe Trading

The Anatomy of Pin Bar. A pin bar is a unique candlestick pattern in trading, and it is essential to understand its anatomy to effectively use it in trading strategies.The pin bar consists of a small body, a long tail or wick, and a shorter shadow on the opposite side of the tail. The body of the pin bar represents the price range between the opening and closing prices for the time period.

Pin Bar Trading Strategies that Work Pro Trading School

Figure 5: pin bar pattern with trend lines. In Figure 5, we have an example of trading trend lines with pin bar confirmation. Here, we first plotted a down sloping falling resistance line connecting the first two lows. As price continues to fall further with the trend line acting as resistance, towards the end, we notice a strong bullish pin bar.

5 Pin Bar Trading Strategies in Forex

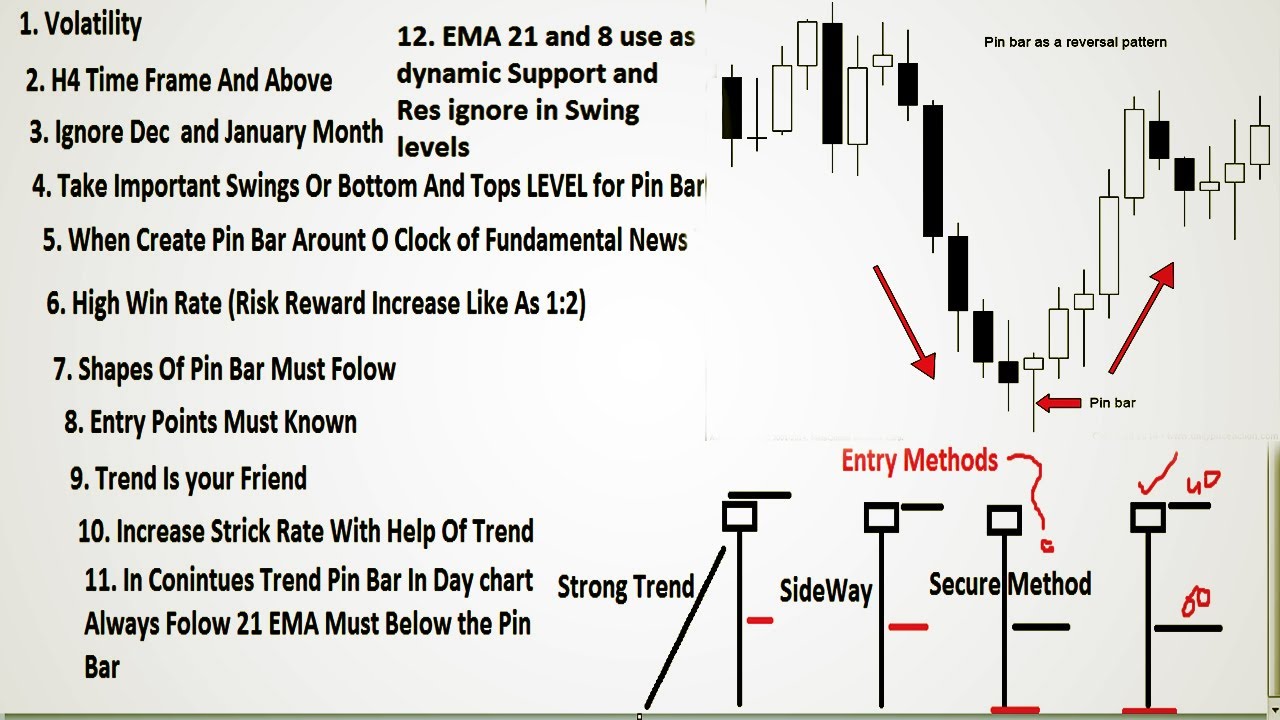

Pin bar trading strategies. When choosing a trading strategy using a pin bar, there are some key points to consider: pin bar detection; determining the entry point to the market; setting a stop and profit; deal management. moving averages. Two EMA lines with a period of 200 can serve as S/R levels. The opening point of the transaction is the.

Pin Bar Trading Strategies that Work Pro Trading School

To get our pin bar entry level using the 50% rule, we simply drag the Fibonacci Retracement tool from the top of the pin bar tail to the bottom of the pin bar nose. Of course if this were a bullish pin bar we would drag the Fibonacci Retracement from the bottom of the tail to the top of the nose.

Pin Bar Forex Trading Strategy

This bullish pin bar's range here is $30 which is more than 1.5 times the ATR. So if you get a Pinbar at least 1.5 times the ATR, then it's telling you there's conviction behind the move. A Pinbar trading strategy that works. Now: Let's put what you've learned and developed a Pinbar trading strategy. You'll need to answer these 5.

Pin Bar Trading Strategies that Work Pro Trading School

Although Pin Bars are not a trading system in themselves, they can be used to predict turning or continuation points in the market. You also have to take the timeframe into account. Pin Bars on higher timeframes like the daily or 4 hour charts tend to be more reliable than ones on the 1 minute chart. Pin Bar Exercise. Now it's your turn.

How to Trade Forex Using Pin bar Trading Strategy

The pin bar is a price action reversal pattern that shows that a certain level or price point in the market was rejected. The actual pin bar itself is a bar with a long upper or lower "tail", "wick" or "shadow" and a much smaller "body" or "real body". You can find pin bars on any stripped-down candlestick chart.

Pin Bar Trading Strategy for Forex and Crypto With Free PDF

In general, when trading pin bars, speculators should look for big candle wicks forming beyond the recent price action after a prolonged price move. There are usually the best pin bar formations to trade. However, pin bars can also be valid during a trend, as prices are taking a pause or taking a breather prior to the resumption of that trend.

1 Pinbar Trading Strategy TradingwithRayner

The pin bar formation is a reversal setup, and we have a few different entry possibilities for it: "At market entry" - This means you place a "market" order which gets filled immediately after you place it, at the best "market price". A bullish pin would get a "buy market" order and a bearish pin a "sell market" order.

Pin Bar trading price action Forex Strategies Forex Resources

Here are a few ways to incorporate Pin Bars into your trading approach: 1. Reversal Trading: As Pin Bars indicate potential trend reversals, traders can enter trades in the opposite direction of the previous trend. For example, if a bullish Pin Bar forms after a downtrend, it may signal a potential trend reversal, and traders can consider.

Practical Pin Bar Trading Strategies Tendencia del mercado Mercado

Rules for a short entry. Mark the key levels and identify trend lines. When a pin bar is formed at the important resistance level, place a "Sell" order 10-20 points below the pin bar's low. Place a Stop Loss 20-30 points above the resistance line that caused the rejection of prices. Place a Take Profit when the price gets twice or three.