Discounted Payback Period Definition, Formula, Benefits eFM

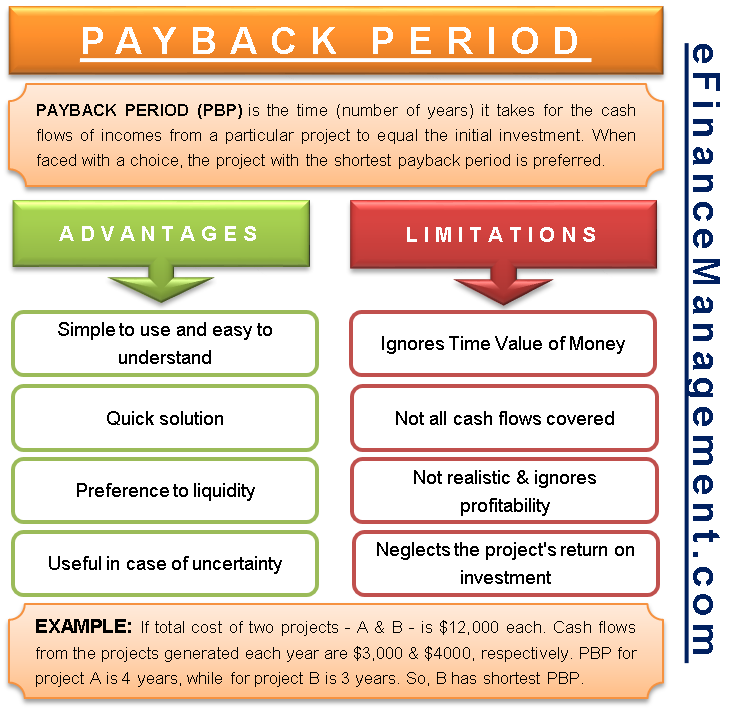

Conclusion Frequently Asked Questions (FAQs) For instance, if the total cost of two projects - A and B - is $12,000 each. But, the cash flows of income of both the projects generate each year are $3,000 and $4000, respectively. The payback period for project A is four years, while for project B is three years.

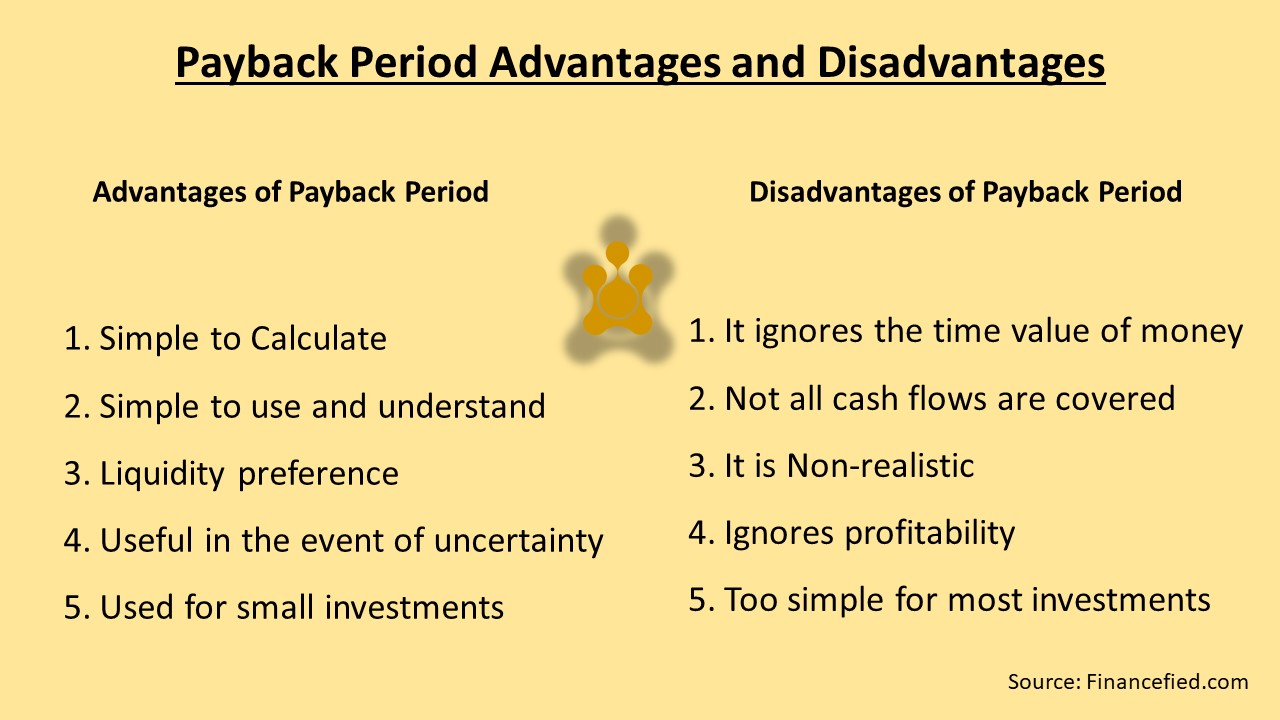

Payback Period Advantages and Disadvantages Techniques of Capital Budgeting

Updated May 26, 2021 Reviewed by David Kindness The payback period refers to the amount of time it takes to recover the cost of an investment. Moreover, it's how long it takes for the cash flow.

Payback Period Advantages and Disadvantages Top Examples

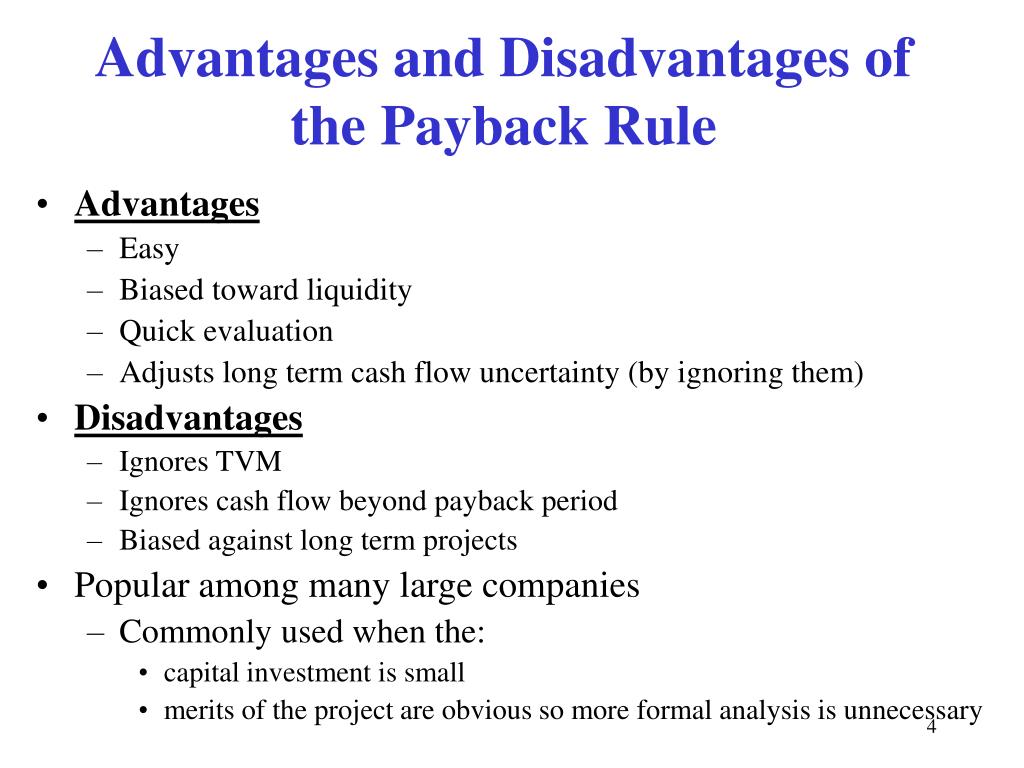

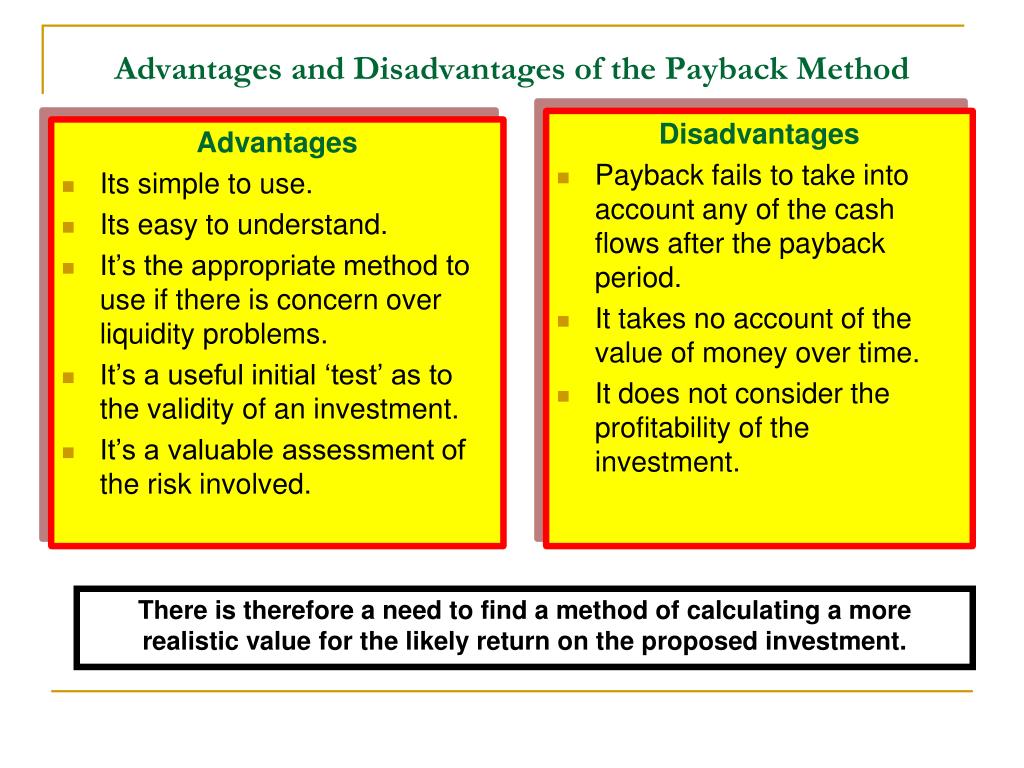

1. It Is a Simple Process. One of the biggest advantages of using the payback period method is the simplicity of it. You base your decision on how quickly an investment is going to pay itself back, and that is done through forecasted cash flow.

ADVANTAGES AND DISADVANTAGES OF PAYBACK PERIOD METHOD YouTube

1 Advantages of payback period 2 Disadvantages of payback period 3 Alternatives to payback period 4 How to use payback period effectively 5 Here's what else to consider The.

Chap006

It helps evaluate liquidity risk - projects with shorter payback have less risk as the initial investment is recovered quicker. It is used to compare projects - projects can be ranked by payback period for capital rationing decisions. It is easy to calculate with limited data

Advantages and Disadvantages of Payback Method GenevieveoiHendrix

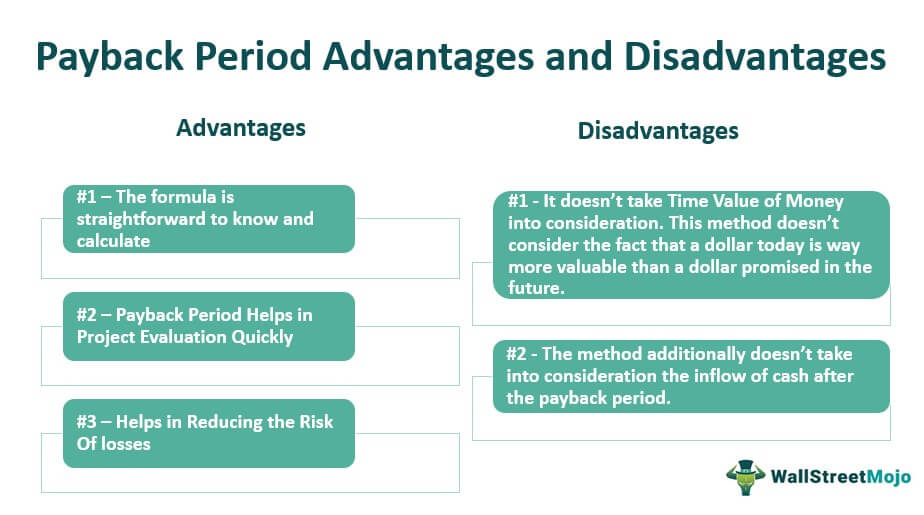

Advantages and Disadvantages of the Payback Period One of the biggest advantages of the payback period method is its simplicity. The method is extremely simple to understand, as it only requires one straightforward calculation. Hence, it's an easy way to compare several projects and then to choose the project that has the shortest payback time.

Advantages And Disadvantages Of Payback Period Pdf Otosection

The principal advantage of the payback period method is its simplicity. It can be calculated quickly and easily. It is easy for managers who have little finance training to understand. The payback measure provides information about how long funds will be tied up in a project.

Advantages and Disadvantages of Payback Period

Disadvantages of Payback Period. 1. It ignores the time value of money. By the time value of money, I mean considering inflation and its impact on currency purchasing power. The payback period completely disregards that fact and only focuses on the period it takes to return the investments.

Disadvantages and Advantages of Payback Period eFinanceManagement

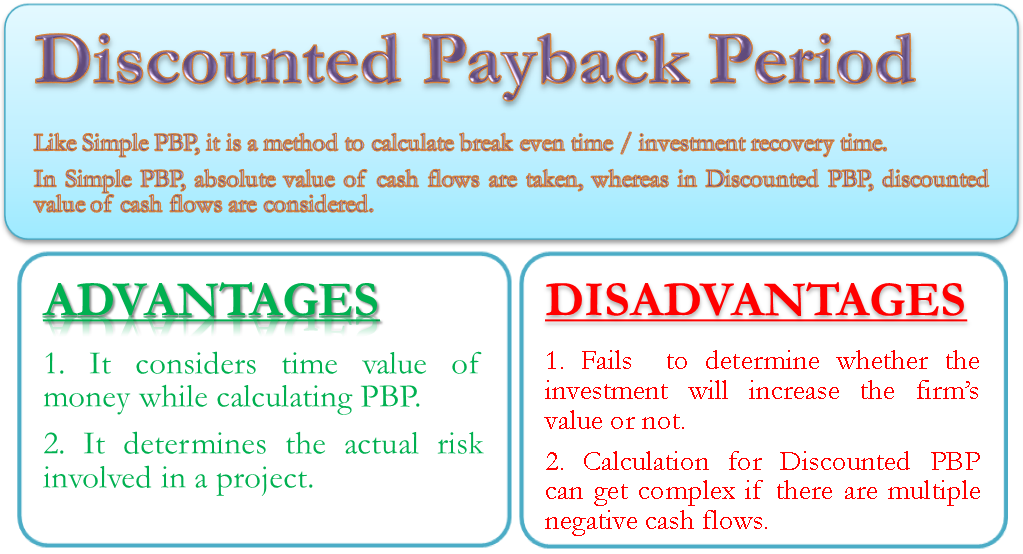

Advantages Disadvantages Conclusion Discounted Cash Inflow = Actual cash inflow / (1 + i) n Here, it refers to the discount rate, and n refers to the period for which the cash inflow relates In the next step, we calculate the discounted payback period using the following formula: Discounted Payback Period = A + B / C Here,

Advantages And Disadvantages Of Payback Period BenefitsDrawbacks

Solution: Since the annual cash inflow is even in this project, we can simply divide the initial investment by the annual cash inflow to compute the payback period. It is shown below: Payback period = $25,000/$10,000 = 2.5 years

PPT Valuation Methods & Capital Budgeting PowerPoint Presentation ID261165

The main advantages of payback period are as follows: A longer payback period indicates capital is tied up. Focus on early payback can enhance liquidity Investment risk can be assessed through payback method Shorter term forecasts This is more reliable technique The calculation process is quicker than and simple than any other appraisal techniques

Advantages and disadvantages of payback period pdf

Calculate payback period. List the advantages and disadvantages of using the payback period method.. When the payback period method is used, a company will set a length of time in which a project must recover the initial investment for the project to be accepted. Projects with longer payback periods than the length of time the company has.

Payback Period Advantages and Disadvantages Financefied

The main advantages and disadvantages of using Payback as a method of investment appraisal are as follows: Advantages of Payback Simple and easy to calculate + easy to understand the results Focuses on cash flows - good for use by businesses where cash is a scarce resource

PPT BUSINESS AND MANAGEMENT PowerPoint Presentation, free download ID6414822

Financial Analysis Use for Small Investments The payback period is especially useful for a business that tends to make relatively small investments, and so does not need to engage in more complex calculations that take other factors into account, such as discount rates and the impact on throughput. Simplicity

Payback Period Method Meaning, Formula, Calculations, Advantages & Disadvantages

The most significant advantage of the payback method is its simplicity. It's an easy way to compare several projects and then to take the project that has the shortest payback time. However,.

Advantages and Disadvantages of Payback Period

Advantages of the Payback Method Payback period as a tool of analysis is easy to apply and easy to understand, yet effective in measuring investment risk. LEARNING OBJECTIVE Describe the advantages of using the payback method KEY POINTS